Price of Private Non-landed Houses vs HDB

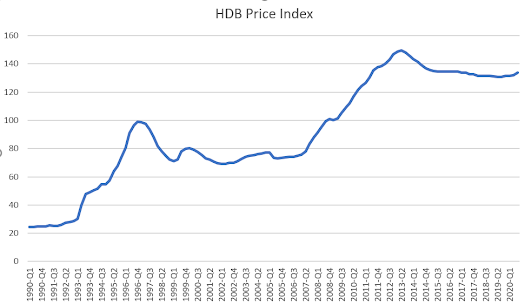

Let's take a look at the average price of Non-Landed Private Properties (eg. condo) This includes all the non-landed houses in Singapore, in all regions. At this time of writing Q4 2020 prices is not available yet. For Year 2020, it is the average price index of Q1-Q3. As you can see, after 2017, the price level of properties do not increase as much. How does it compare to HDB? The above shows the price index of Non landed private properties as compared to resale price index of HDB. As you can see, from 2015 onwards, the price of non-landed private properties continue to increase while the price levels of HDB remain relatively flat. Which do you think is a better investment? For most people, to get a profit you have to buy low and sell high. If you buy a HDB or non landed property at around the time of the first red circle at around 2009, you will likely be able to make a profit if you sell the property in 2013. Similarly if you buy a non landed property in 2017 and sell at 201