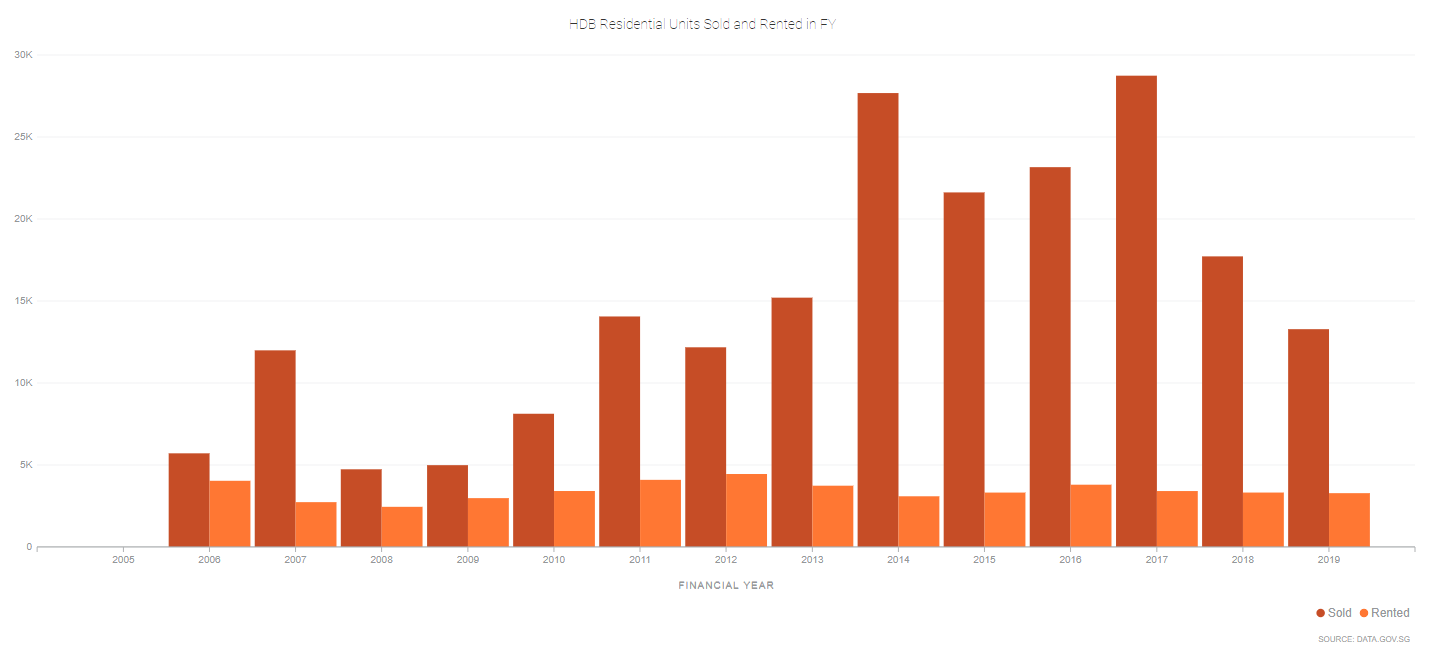

Declining population in Singapore

Recently, the Straits Times reported that the population declined in Singapore. There is a a 4.1 per cent drop in overall population. The non-resident population fell by 10.7 per cent to 1.47 million, Singapore's citizen population also decreased by 0.7 per cent to 3.5 million, while the permanent resident (PR) population fell by 6.2 per cent to 0.49 million. The news point out that the main reason of the fall is due to the covid pandemic and the travel restrictions that are in place. Some have said that such fall is worrying, with the falling number of foreigners, will it affect the talent pool in Singapore, the economy as well as the property market in Singapore? Well I guess it might affect the talent pool in Singapore, but this could be temporary given that Singapore is opening up, and travel restrictions are slowly easing. But besides this point, we need to note that more are working from home and working remotely. Many businesses have reduced the need for office space. For