Let's take a look of STI vs Housing Price Index

Here's the Straits Times Index ETF from 2008.

Here is the price chart of the Straits Times Index (STI) ETF (ES3), which tracks the performance of the Straits Times Index taken from yahoo finance. As you can see, if you entered and bought some STI ETF in the year 2010 at around 3.02, 10 years later in year 2020, you might incur a loss as the average price of 2020 is around 2.744. Hopefully the dividends earned from the ETF which yield is around 3-4% per year will help to cover the losses.

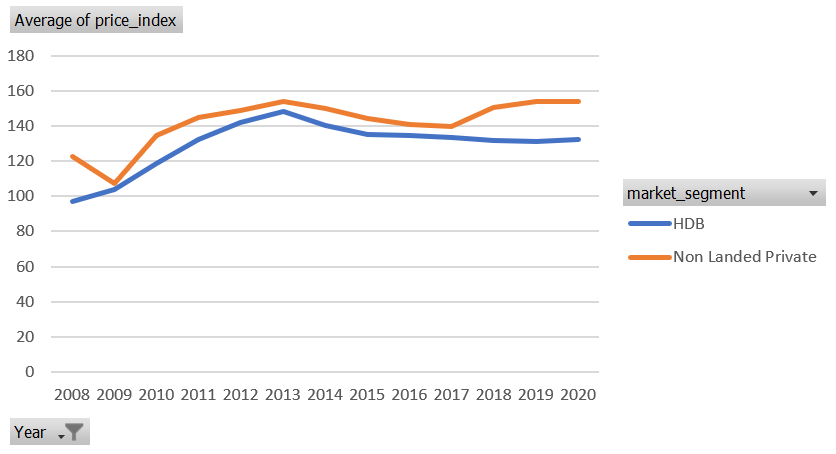

Let's compare it with the Price Index chart for HDB and Non Landed Private Housing.

The trend of the price index of STI and Non Landed Private Housing looks similar, up to 2020, where we see the tanking of the STI while the prices of houses did not fall as much.

There are probably several reasons for this.

The covid that happened in 2020 has changed the lifestyle for many. During the circuit breaker, students have to learn from home while office workers work from home. Many realised they require more space and some began looking for bigger houses.

Second reason is that because of the low interest rate now, many find that it is the right time to buy houses, before interest rate increase in future.

Sources:

https://sg.finance.yahoo.com/quote/ES3.SI/history?p=ES3.SI

https://data.gov.sg/

Comments

Post a Comment